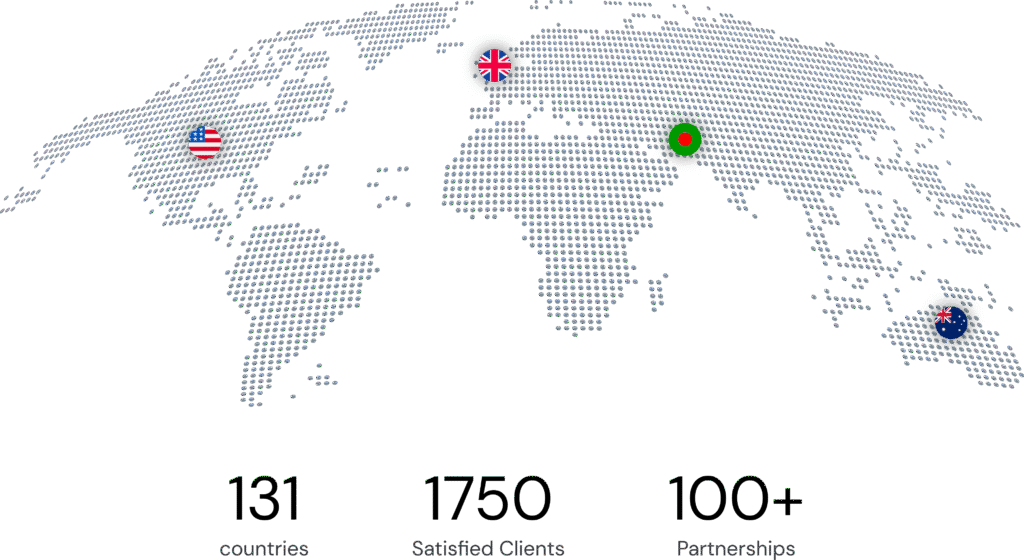

Trusted by international clients worldwide. We handle your ITIN application with expert care, guaranteed results, and personalized support throughout the entire process.

Processing Time

Data Protection

Success Rate

We are officially authorized by the Internal Revenue Service to assist with ITIN applications. Our certification ensures you receive professional, compliant service backed by federal authorization.

Publicly verifiable on IRS.gov directory

Official authorization documentation available

Regular audits and compliance monitoring

Unlock opportunities & ensure tax compliance in USA, UK, BD, AUS

File your taxes in the U.S. accurately and in full compliance with all applicable legal requirements.

Claim reduced tax rates or exemptions on certain income under agreements between countries.

Get access to U.S. bank accounts, PayPal, and Stripe so you can send/receive payments worldwide.

Apply for credit cards to access convenient spending, build credit, and enjoy rewards based on your card type.

Start or grow your U.S. business with expert guidance, strategic advice, and compliance support.

Avoid IRS penalties by staying compliant with tax rules, filing accurately, and meeting all deadlines.

See our step-by-step process and learn why thousands of clients trust us with their ITIN applications online.

We determine your eligibility and specific requirements for an ITIN.

As an ITIN certified acceptance agent (CAA), we verify your identification documents in-house, so you don’t have to send originals to the IRS.

Our team completes and reviews your IRS Form W-7, ensuring accuracy for your ITIN application online.

We file your application directly with the IRS on your behalf, helping you obtain an ITIN number online, and follow up once the ITIN is issued.

"Reliable and Accurate!"

“I wasted time with sketchy online services before finding House of Bookkeeper. Their track record speaks for itself: quick responses, no template replies, and real expertise. Best decision I made!”

"My ITIN Number Came Fast!"

“I needed an ITIN to file my U.S. taxes, and House of Bookkeepers handled everything fast. The process was smooth and hassle-free!”

"Perfect for Non-Residents!"

“As a non-resident, I struggled with tax filing until I found House of Bookkeepers. Their guidance was clear, and they maximized my tax benefits!”

"Top-Notch Bookkeeping!"

“Their bookkeeping services keep my business finances in perfect order. I now have better insights and more time to focus on growth!”

Stress-Free Finances

“Thanks to their expert bookkeeping, I finally have a clear picture of my finances. It’s saved me so much time and stress, letting me focus on growing my business!”

With an ITIN, access tax benefits, build credit, and apply for accounts. Without it, face delays, rejections, and limits.

| Feature | With ITIN | Without ITIN |

|---|---|---|

| Tax & Legal | ||

| File U.S. Tax Return | You can file 1040-NR legally | Cannot file U.S. taxes or claim refunds |

| Claim Tax Treaty Benefits | Reduce or eliminate U.S. tax liability | Pay full withholding (usually 30%) |

| LLC Owner Tax Compliance | Can file Form 1040-NR, 5472, and 1120 | High risk of non-compliance and IRS penalties |

| Financial Services | ||

| Open U.S. Bank/Stripe/PayPal | ITIN accepted for identity verification | Account verification may be rejected |

| Build Limited U.S. Credit History | Sometimes – Some banks accept ITIN | No U.S. credit profile without tax ID |

| Business & Commerce | ||

| Get EIN For Sole Proprietor | ITIN helps apply for EIN | IRS may reject EIN request without ITIN |

| Amazon/Etsy Seller Verification | Accepted for tax verification | Approval may fail due to missing tax data |

| Personal Benefits | ||

| Claim Dependents (if eligible) | May claim spouse/children on tax return | Not eligible to claim dependents |

| IRS Refunds & Letters | Receive official IRS letters & refunds | Cannot claim refunds or track IRS status |

| Limitations | ||

| Work Legally in the U.S. | ITIN is not a work authorization | Not allowed without SSN/visa |

| Social Security or Immigration Use | ITIN cannot be used for immigration/work | Still ineligible |

To process your ITIN application, the following information is needed

High-quality scanned copy of your current passport

Your home country address

US address (If you don’t have one, you can rent mine.)

Whether you’re an individual, a small team, or a growing enterprise, we have a plan that aligns perfectly with your goals.

Your payment is protected with Stripe — one of the most secure gateways in the world.

CFO, House of Bookkeepers LTD

Founder & CEO, House of Bookkeepers

ITIN Expert, House of Bookkeepers

An ITIN (Individual Taxpayer Identification Number) is an identification number issued by the IRS for individuals not eligible for a Social Security Number (SSN) but required to pay U.S. taxes.

ITIN is only for foreign nationals and others who have federal tax filing or reporting requirements but do not qualify for a Social Security Number (SSN). Examples include:

Non-U.S. citizens who do not qualify for an SSN

Non-U.S. resident aliens required to file a U.S. tax return

U.S. resident aliens filing a U.S. tax return

Dependents / spouses of U.S. citizens or resident aliens

Dependents / spouses of non-U.S. resident alien visa holders

Once you submit your application through an ITIN application service, the IRS usually processes it within 8–13 weeks.

Expired ITINs must be renewed to file taxes and avoid processing delays. This applies to all ITIN holders, including those with an ITIN number for child or ITIN number for spouse.

No, an ITIN does not authorize employment. It is solely for tax purposes.

Find out which Tax ID is right for you:

Book a free consultation call today.

Successfully assisted 1750 clients.

Partnerships with QuickBooks Online, Xero, Wave, Mercury Bank, and more.

100+ fintech companies served.

Our commitment is simple: clear communication, 100% transparency, and a money-back guarantee for every service.

Registered Agent Service + Virtual Mailing/Business Address: $69 per year

State Annual Report Fees: Varies by state