Bookkeeping, USA LLC formation, ITIN applications, and Tax prep, all in one place. Book a free consultation today and take the next step toward organized finances and smoother growth.

House of Bookkeepers will guide you through the process of the services you are looking for.

If you're ineligible for an SSN but need to comply with U.S. tax laws, an ITIN allows you to file taxes, claim credits (CTC, AOTC), open bank accounts, apply for loans, and report income from U.S. sources like rentals or investments. It also helps spouses and dependents file tax returns seamlessly.

An ITIN is an identification number issued by the IRS for individuals not eligible for a Social Security Number (SSN) but required to pay U.S. taxes.

Non-residents, foreign nationals, dependents, spouses, and international students needing to comply with U.S. tax regulations.

You must submit Form W-7 with required documents and a valid tax reason, usually with a tax return.

A valid passport copy, address details, and supporting tax documents are required.

Keeping your books in order is essential for running a successful business, but it can be time-consuming and overwhelming. At House of Bookkeepers (HOB), we provide professional Monthly Bookkeeping Services to ensure your financial records are accurate, organized, and compliant. From categorizing transactions to generating financial reports, we handle the details so you can focus on growing your business.

Our service includes transaction recording, categorization, reconciliation, and financial reporting to ensure your records are accurate and complete.

We provide monthly updates, but we’re available for additional support or reporting as needed.

Navigating U.S. tax requirements as a non-resident can be complex. At House of Bookkeepers (HOB), we specialize in providing Non-Resident Tax Filing Services, ensuring compliance with IRS regulations while optimizing your tax situation. Whether you’re an international investor, student, or freelancer with U.S. income, we handle the intricacies of your tax obligations with accuracy and care.

If you earned income from U.S. sources or meet other filing criteria, you are required to file a U.S. tax return, typically using Form 1040-NR.

A tax treaty is an agreement between the U.S. and another country to prevent double taxation. We analyze treaties to determine if you qualify for reduced rates or exemptions.

Establishing a legal presence in the United States can be daunting for international entrepreneurs. At House of Bookkeepers, we specialize in seamless Company Formation and USA LLC Setup, removing the bureaucratic hurdles so you can focus on growth.

Whether you are an e-commerce seller, a digital nomad, or a startup founder, we handle the intricacies of state filings, Registered Agent services and EIN acquisition to ensure your business is operational and compliant from day one.

Yes. International entrepreneurs and non-residents can legally form an LLC in the U.S. You do not need to be a U.S. citizen or have a green card. However, you will need a Registered Agent and may require an ITIN or EIN, which we assist with.

Not exactly. While U.S. law requires a physical address for legal correspondence (you cannot just use a P.O. Box), you do not need to rent an office yourself. We provide a Registered Agent service and a Virtual Business Address to satisfy this legal requirement for you.

"Reliable and Accurate!"

“I wasted time with sketchy online services before finding House of Bookkeeper. Their track record speaks for itself: quick responses, no template replies, and real expertise. Best decision I made!”

"My ITIN Number Came Fast!"

“I needed an ITIN to file my U.S. taxes, and House of Bookkeepers handled everything fast. The process was smooth and hassle-free!”

"Perfect for Non-Residents!"

“As a non-resident, I struggled with tax filing until I found House of Bookkeepers. Their guidance was clear, and they maximized my tax benefits!”

"Top-Notch Bookkeeping!"

“Their bookkeeping services keep my business finances in perfect order. I now have better insights and more time to focus on growth!”

Stress-Free Finances

“Thanks to their expert bookkeeping, I finally have a clear picture of my finances. It’s saved me so much time and stress, letting me focus on growing my business!”

House of Bookkeepers will guide you through the process of the services you are looking for.

In your free 15-minute consult, a specialist accountant will review your finances with you to highlight where you can save money and offer practical advice.

During your consultation, your accountant will help you determine which package (Starter or Premium) best meets your business's needs.

Your accountant will then guide you through the initial stages of populating your dashboard. Then you'll receive your login details so you can complete the setup.

Tailored bookkeeping for Texas roofers—track job costs, manage expenses, and keep your business financially on point.

We handle your restaurant’s books—sales, payroll, and expenses—so you can focus on great service.

Organized, stress-free bookkeeping for cleaning businesses—track income, expenses, and stay tax-ready all year round.

Simple, reliable bookkeeping for small businesses. Stay tax-ready, organized, and focused on growing your business with confidence.

Professional ITIN application service for non-residents. We assist with IRS Form W-7, document verification, and help you obtain an ITIN number online with guidance from a certified acceptance agent.

ITIN service for international and F1 students applying for an individual taxpayer identification number. Support includes W7 form online submission and complete US ITIN application assistance.

Apply for an ITIN number for spouse or child with proper IRS documentation. Our ITIN certified acceptance agent reviews and submits your ITIN application online accurately.

ITIN service for LLC owners and foreign business operators. We help with how to get an ITIN number for non-resident business use and ensure compliance with IRS requirements.

Set up your Wyoming LLC as a non-US resident with ease. Our service includes LLC registration, registered agent support, filing assistance, and guidance on banking and taxes for non-US owners.

Start your Texas LLC quickly with our complete online support. We help with registration, filing fees, single-member LLC setup, and same-day LLC formation in Houston, Dallas, and Austin.

At House of Bookkeepers, we provide IRS-certified bookkeeping, ITIN, tax filing, and business formation services to keep your finances accurate and compliant. Our expert team ensures seamless record-keeping, maximized tax savings, and stress-free business setup, so you can focus on growth.

Get your business set up and tax-ready with House of Bookkeepers. Whether you’re launching a new company or need seamless tax filing, our IRS-certified experts ensure compliance, accuracy, and maximum savings.

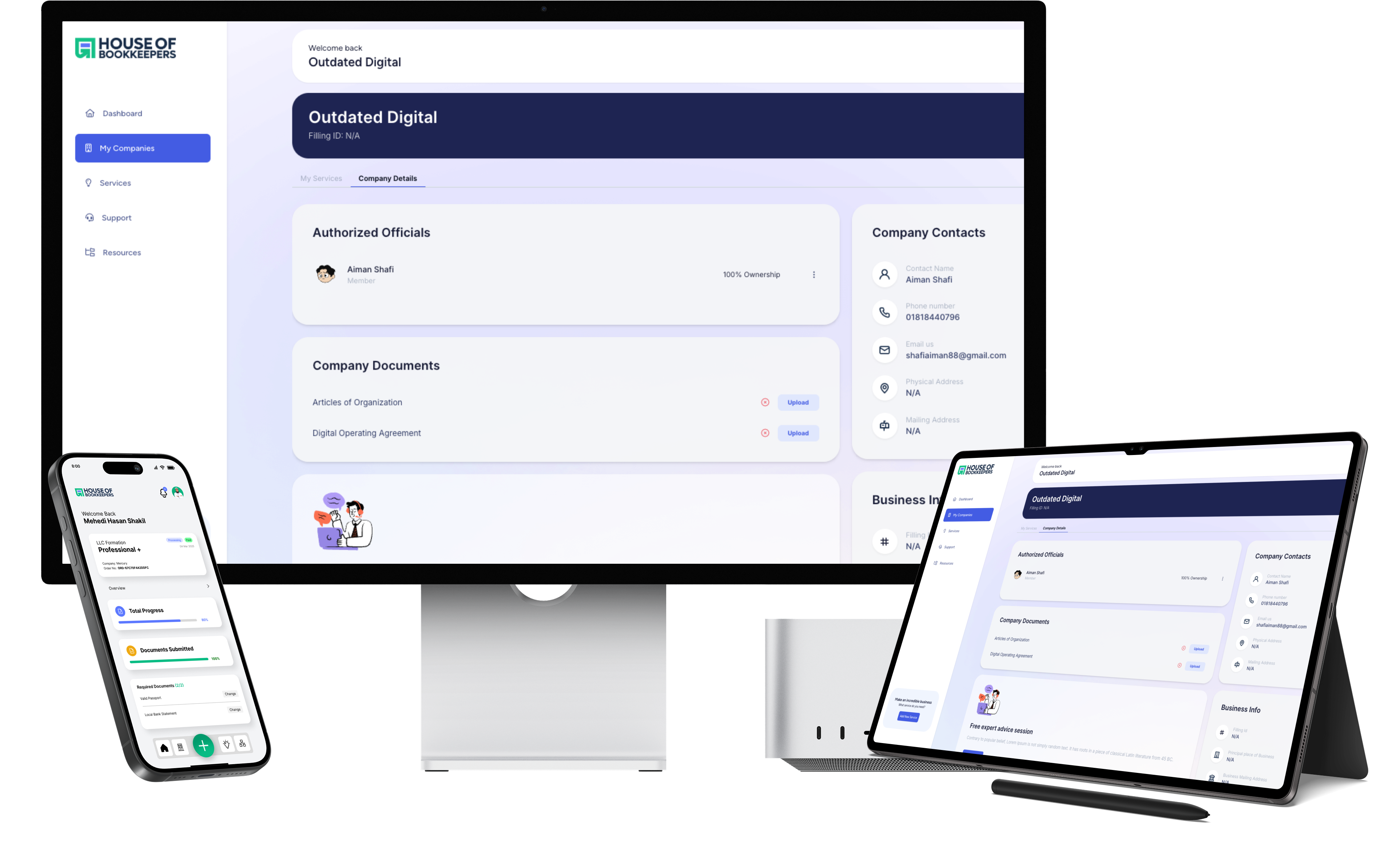

Take full control of your bookkeeping, tax filings, and business formation with our intuitive Customer Dashboard. Designed for ease and efficiency, it lets you track finances, submit documents, and access expert support—all in one place.

At House of Bookkeepers, we understand that financial questions don’t follow a 9-to-5 schedule. That’s why we offer 24/7 expert support, ensuring you get the help you need—whenever you need it.

House of Bookkeepers will guide you through the process of providing the services you are looking for, as well as everything you need: Business essentials and reminders in one place.

An LLC offers flexible management and tax benefits, while corporations have stricter regulations but allow for easier fundraising through stocks.

Yes, non-residents can form a US-based company without a Social Security Number.

Having an ITIN gives you the power to:

Using a CAA: 3–6 weeks is typical.

Mailing it yourself: 8–12+ weeks, especially during tax season.

A Registered Agent is required by law to receive legal documents on behalf of your LLC. We provide this service nationwide.

An EIN is used for tax filing, opening business bank accounts, and hiring employees.

If you hire employees, operate as a corporation or partnership, or file excise taxes, you need an EIN.

A US bank account allows smoother transactions, lower fees, and access to global markets.

We work with banks such as Mercury, Relay, Payoneer, and Wise.

We support QuickBooks, Xero, Wave, Excel, and Zoho Books.

Services include transaction categorization, reconciliation, reporting, and financial statement preparation.

Let House of Bookkeepers simplify your bookkeeping, tax filing, itin and LLC formation services. Whether you’re a startup or an established business, our IRS-certified bookkeeping experts ensure accurate financial management, tax compliance, and business protection. Start today and set your business up for long-term financial success!

Registered Agent Service + Virtual Mailing/Business Address: $69 per year

State Annual Report Fees: Varies by state