Offer ends In

Get your Annual Report Filing in 24 hours only at $99

- Easy & Timely Annual Report Filing

Stay Compliant with Hassle-Free Annual Report Filing

Annual Report Filing is a critical requirement for businesses to maintain compliance with state regulations. It involves updating state authorities with your business’s latest information, such as ownership details, contact information, and operational status. At House of Bookkeepers (HOB), we streamline the process of filing your annual report, ensuring timely submission and helping you avoid penalties or loss of good standing.

Excellent

567+ reviews

- PROCESS IN 24H

How the Service Works

- STEP 01

Consultation

We review your business structure and identify your state’s specific filing requirements.

Information Gathering

Our team collects the necessary details, including updated business contact information, ownership structure, and registered agent details.

- STEP 02

- STEP 03

Report Preparation

We complete your annual report with accuracy and ensure it meets all state guidelines.

- STEP 04

Filing Submission & Follow Up

Your report is submitted to the appropriate state agency on time. We confirm acceptance of your filing and provide you with a copy for your records.

- Who This Service Is For

Our Annual Report Filing service is ideal for

LLCs, corporations, and nonprofits required to file annual or biennial reports.

Business owners managing multiple entities across various states.

Companies looking to avoid the hassle of navigating state-specific filing requirements.

Businesses aiming to maintain compliance without disruption.

- Why You Need to File an Annual Report

Filing your annual report is essential for

- Stay in good standing with the state to avoid fines or administrative dissolution.

- Ensure state records accurately reflect your business’s current information.

- Late or missed filings can result in costly penalties or loss of good standing.

- Show clients, investors, and partners that your business is organized and compliant.

- OUR PARTNERS

House of Bookkeepers Reliable Partners

Requirements for Annual Report Filing

To complete your annual report filing, the following information is typically required

- Business name and registration number.

- Updated business address and contact details.

- Names and addresses of officers, directors, or members.

- Registered agent information.

- State-specific fees associated with the filing.

- TESTIMONIALS

Hear what our clients have to say?

"Reliable and Accurate!"

“House of Bookkeepers made tax season stress-free! Their expertise ensured my filings were accurate and on time. Highly recommend!”

- Michael R.

"Perfect for Non-Residents!"

“As a non-resident, I struggled with tax filing until I found House of Bookkeepers. Their guidance was clear, and they maximized my tax benefits!”

- Arjun P.

"Top-Notch Bookkeeping!"

“Their bookkeeping services keep my business finances in perfect order. I now have better insights and more time to focus on growth!”

- Lisa M

"Helped Me Claim Tax Credits!"

“I had no idea I qualified for tax credits. House of Bookkeepers helped me claim the CTC and AOTC, saving me money!”

- Carlos D.

"Seamless ITIN Process!"

“I needed an ITIN to file my U.S. taxes, and House of Bookkeepers handled everything efficiently. The process was smooth and hassle-free!”

- Sofia G.

"Shakil Is Superb!"

“From tax filing to bookkeeping, they handle everything with professionalism and care. I feel secure knowing my finances are in good hands!”

- Emma T.

- Flexible pricing plans

Simple investment for everything your business needs

Whether you’re an individual, a small team, or a growing enterprise, we have a plan that aligns perfectly with your goals.

Initial Package:

- POPULAR

$99 $118 /plus state fees

- Includes report preparation and submission to the state agency.

Compliance Package

$149 $178

/ plus state fees

- For businesses needing urgent processing with priority submission.

Multi-State Filing Package

$149 $178 / Starting

- Contact us for pricing Ideal for businesses operating in multiple states requiring annual report filings in several jurisdictions.

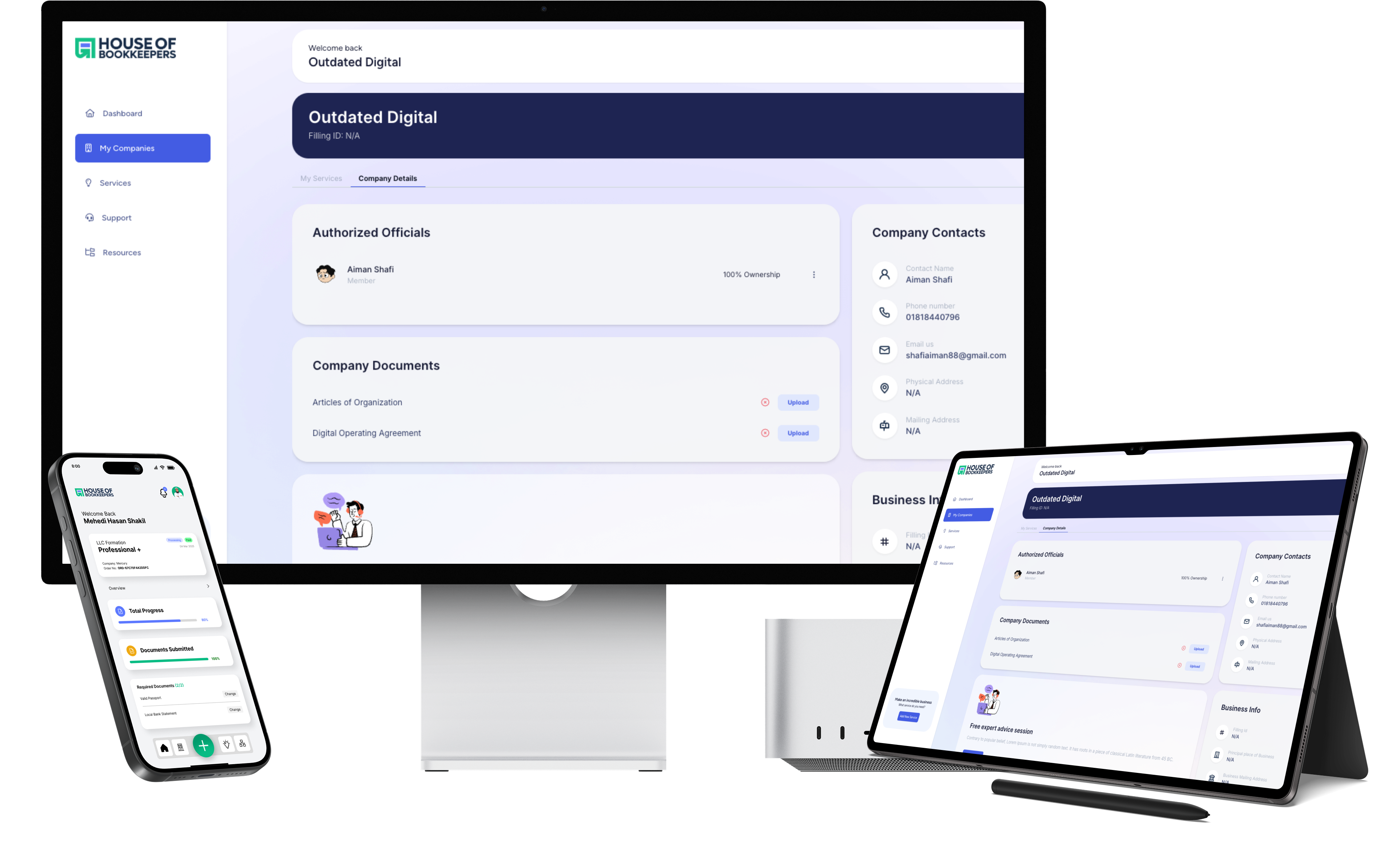

- ALL IN ONE PLATFORM

Your Personalized Dashboard

House of Bookkeepers will guide you through the process of providing the services you are looking for, as well as everything you need: Business essentials and reminders in one place.

- Key Features and Benefits

What Makes Our Service Stand Out

Accurate and Timely Filing

Avoid penalties with our professional and punctual service.

State-Specific Expertise

We handle filings for all 50 states, tailoring our services to meet unique requirements.

Compliance Assurance

Ensure your business remains in good standing with state authorities.

Hassle-Free Process

Let our experts handle the paperwork, so you can focus on running your business.

- Why Choose Us?

Why We’re the Right Choice for You

Trusted Experts

With years of CAA experience, we've helped countless clients secure their ITINs.

Client-Focused Service

We provide personalized attention to every application.

Secure and Confidential

Your sensitive information is handled with the utmost care.

Transparent Pricing

No hidden fees—just reliable service at competitive rates.

- FAQ

Frequently Asked Questions

What is an annual report?

An ITIN is an identification number issued by the IRS for individuals not eligible for a Social Security Number (SSN) but required to pay U.S. taxes.

Do all businesses need to file an annual report?

Non-residents, foreign nationals, dependents, spouses, and international students needing to comply with U.S. tax regulations.

What happens if I don’t file my annual report?

Once submitted, the IRS typically processes ITIN applications within 6–8 weeks.

How long does the filing process take?

You need to renew your ITIN to file taxes and avoid processing delays.

Can you handle filings for multiple states?

No, an ITIN does not authorize employment. It is solely for tax purposes.

- 8 Years in business

File Your Annual Report Today – Stay Compliant!

Don’t let compliance requirements disrupt your operations. At House of Bookkeepers, we make annual report filing simple, efficient, and stress-free. Contact us today to get started and ensure your business remains in good standing!

Trusted by 234+ companies

Donwload the free LLC PDF

By subscribing you agree with our Privacy policy

Services

- Formation

- Registered agent

- Operating Agreement

- Community

- Marketplace

Company

- About us

- Careers

- FAQ

- Partner with us

- Blog

- Press

Compare

- HOB vs. Stripe Atlas

- HOB vs. LegalZoom

- HOB vs. ZenBusiness

- HOB vs. Alternatives